Commercial property insurance provides financial security for your workspace and its contents, often required by landlords when signing a lease agreement.

Liability Insurance Coverage For Contractors - Product liability

- Certainly, here is the list without bullets:

- Product liability

- Marine insurance

- Policy

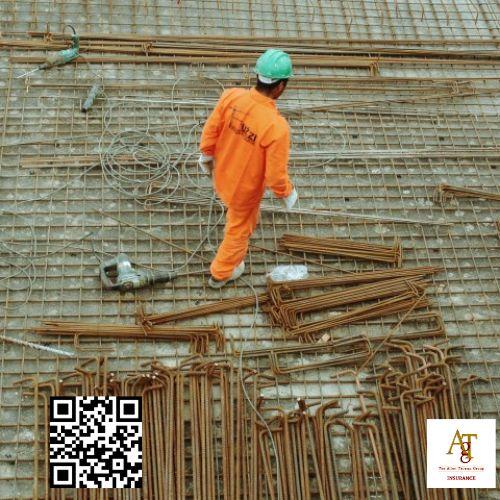

The Allen Thomas Group can swiftly secure customizable Bonds at competitive rates to help you bid on lucrative contracts and grow your business.- Required for bidding on most public and commercial projects- Guarantees you will complete work per contractual terms - Shows financial capacity to take on major construction workKeep Your Crew Covered with Workers' Comp Insurance Employing any workers instantly opens you up to responsibility for job-related illnesses and injuries. When it comes to contractor insurance, it is important to understand the different coverage options available. Avoid choosing coverage based on cost alone and work with agents who truly understand your business. Avoid choosing coverage based on cost alone and work with agents who truly understand your business.

Yet many make the mistake of being underinsured or having gaps in coverage. When discussing insurance options with The Allen Thomas Group agent, be sure to ask about both costs and advantages of purchasing individual coverage versus being added onto one of your client's policies. Policy limits - higher liability limits and lower deductibles mean higher premiums. Policy limits - higher liability limits and lower deductibles mean higher premiums.

Rather than paying excessively out of pocket, your business continues undisrupted while claims are handled by professionals. Details of coverage, limits, or services may not be available for all business and vary in some states. Contractor insurance is crucial for protecting both contractors and their clients from financial risks and liabilities associated with accidents or property damage. Contractor insurance is crucial for protecting both contractors and their clients from financial risks and liabilities associated with accidents or property damage.

The Allen Thomas Group partners with top contracting insurer Travelers, among others.

Liability Insurance Coverage For Contractors - Professional indemnity

- Certainly, here is the list without bullets:

- Product liability

- Marine insurance

- Policy

- Occurrence-based policy

These documents serve as crucial evidence in case of legal disputes, helping contractors establish their position and protect their rights. For example, if a roof you installed leaks and ruins the homeowner's walls and flooring, their insurance company can come after you to recoup repair costs. For example, if a roof you installed leaks and ruins the homeowner's walls and flooring, their insurance company can come after you to recoup repair costs.