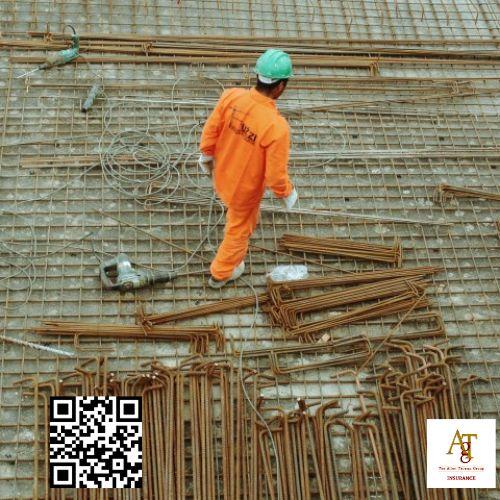

General Liability Insurance For Contractors Near Me

Flood insurance

Timelines, change orders and contract administration can add additional stressors. The Allen Thomas Group . Assists you with covering medical expenses and legal fees associated with defending against an event covered under this plan.

General Liability Insurance For Contractors Near Me - Builders risk insurance

- Flood insurance

- Business interruption

- Builders risk insurance

- Coverage

Our veteran agents take time to explain how policies apply to your real-world scenarios. Our veteran agents take time to explain how policies apply to your real-world scenarios.

Below are key policies every contractor should carry:General liability insurance - This covers claims of bodily injury, property damage, personal injury, and advertising injury. As a contractor, you are responsible for the safety and security of the property you are working on, and accidents can happen. As a contractor, you are responsible for the safety and security of the property you are working on, and accidents can happen.

This protection is required by law in most states. Skilled negotiation can help contractors reach favorable settlements, avoiding lengthy and costly court proceedings. Skilled negotiation can help contractors reach favorable settlements, avoiding lengthy and costly court proceedings.

This ensures that they have adequate coverage in the event of a claim, as exceeding the policy limits could leave them personally liable for any additional costs. The ideal coverage limits depend on your business size and services. The ideal coverage limits depend on your business size and services.

Builders Risk Insurance Companies