If you drive your personal vehicle for work, you should consider hired and non-owned auto insurance (HNOA) to make sure you're protected. We offer options that fit companies with 2 vehicles or 200.- Covers liability and property damage from accident claims - Provides collision, theft and natural disaster protection- Applies to all company-owned motorized equipment With decades of experience, The Allen Thomas Group Insurance Agency has developed specialized expertise when it comes to the contracting industry. Errors and Omissions Insurance, also referred to as E&O or professional liability coverage, provides protection in case an unhappy client sues over your work. Liability coverage helps shield your personal finances.

Business Insurance For Contractors - Garage liability

- Premium audit

- Property insurance

- Subrogation

- Installation floater

- Named perils

Liability coverage helps shield your personal finances.

As a contractor, you want an insurance resource who becomes an invaluable, long-term business partner. It protects your business and is often required by many employers before you can start working for them. An additional insured has less protection than the policyholder, but still gains crucial coverage, such as:Defense coverage. An additional insured has less protection than the policyholder, but still gains crucial coverage, such as:Defense coverage.

Don't leave anything to chance.

Business Insurance For Contractors - Property insurance

- Premium audit

- Property insurance

- Subrogation

- Installation floater

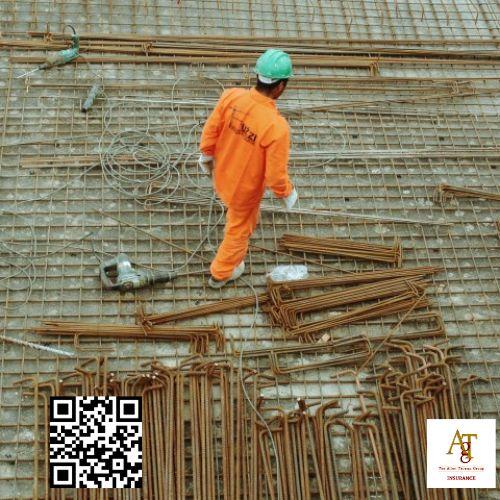

When it comes to protecting against accidents and injuries, contractors have several coverage options available to them. Contractors insurance provides your business with essential protection against financial debt incurred as the result of work-related accidents, and should provide adequate coverages that match its exposure should your livelihood be compromised. Contractors insurance provides your business with essential protection against financial debt incurred as the result of work-related accidents, and should provide adequate coverages that match its exposure should your livelihood be compromised.

How Much Does Contractor Insurance Cost? Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this coverage is crucial for contractors who provide professional services or advice. Contact The Allen Thomas Groups commercial agent for more information and a customized quote. Contact The Allen Thomas Groups commercial agent for more information and a customized quote.